What are New Markets Tax Credits?

The New Markets Tax Credit Program (NMTC Program) was established by Congress in 2000 to spur new or increased investments into operating businesses and real estate projects located in low-income communities. The NMTC Program is administered by the Community Development Financial Institutions Fund (CDFI) and attracts investment capital to low-income communities by permitting corporate investors to receive a tax credit against their Federal income tax liability in exchange for making equity investments in specialized financial institutions called Community Development Entities (CDEs). The credit totals 39 percent of the original investment amount and is claimed over a period of seven years.

Investments made into the CDEs are known as Qualified Equity Investments (QEIs) and are allocated to a range of qualifying businesses and projects referred to as Qualified Active Low Income Community Businesses (QALICBs). California has been designated an underserved state with respect to the NMTC program and projects within this geography are expected to be highly competitive to attract investment.

Current Allocation: The announcement of $10 billion in NMTC allocation authority was made in December 2025. The application for the next round of allocation is expected in mid 2026.

Program Status: The New Markets Tax Program was granted permanent status in July 2025.

Who qualifies for New Markets Tax Credits?

New Markets Tax Credits are offered to Qualified Active Low Income Community businesses that are located in a low income community and benefit targeted populations. A low income community is defined as a US census tract with a poverty rate of above 20% and with a median family income that does not exceed 80% of the area median income. Targeted populations are individuals or an identifiable group of individuals including and Indian tribe who (a) are low income persons or (b) otherwise lack adequate access to loans or equity investments.

What role does Equity Community Builders play?

ECB has substantial experience working with organizations to finance and develop facilities using the NMTC financing structure. Since 2006, we have structured and closed 40 NMTC transactions totaling over $685 million in qualified equity investments. In addition, as a result of our experience as both a developer and project manager on behalf of many nonprofit organizations and historic rehabilitation projects, we bring a depth of understanding and perspective on the larger development, financing, design and construction effort that we have found to be very helpful on these types of projects, even when we are primarily focused on just the tax credit financing.

ECB’s typical role is to coordinate the efforts to secure the New Markets Tax Credit (NMTC) allocation from one or more Community Development Entities (CDEs), secure an investor for the NMTC equity, assist in structuring the financing transaction and guide the project sponsor in coordinating the final documentation and leading the closing process for the financing. .

Completed ECB Tax Credit Projects

Oxford Plaza and David Brower Center

ECB completed the development of the $75 million Oxford Plaza and David Brower Center project in Berkeley in 2009, combining a 50,000 square foot LEED Platinum office and conference center for environmental organizations, 12,000 square feet of restaurant and retail space, and 97 units of affordable housing over a 100 space underground public parking garage. A complex funding structure incorporates over 15 funding sources and $41 million of New Markets Tax Credit allocation. Leveraged loan sources included Section 108 Loans, bank financing, grants, charitable contributions, and other public financing sources. Funding occurred in 2007 and the project was completed in 2009.

- NMTC Investor – USBank

- CDEs – Opportunity Fund, Clearinghouse CDFI, USBCDC (USBank)

Geneva Car Barn

ECB Secured $12.1 million in NMTC allocation to renovate the Powerhouse building of the Geneva Office Building and Powerhouse. The Powerhouse has been adapted into a new youth arts center and a community meeting place, including the creation of new studio and exhibition spaces. This project revitalizes a historic building at the center of several dense urban neighborhoods to provide young people job skills through arts education. The renovation of the Powerhouse represents an approximately $34 million investment.

- CDE - San Francisco Community Investment Fund

PlaceMade/The Foundry

The Foundry offers permanently affordable rental space for San Francisco’s community of local manufacturing businesses. In April 2018, PlaceMade closed on $24.4 Million in NMTC financing for 54,000 SF of new industrial production, distribution and repair space for its tenants. ECB partnered with Capital One and San Francisco Community Investment Fund and debt provider Northern California Community Loan Fund on the transaction.

- NMTC Investor – Capital One

- CDEs – San Francisco Community Investment Fund, Capital One

Ed Roberts Campus

ECB was the Development/Project Manager for the Ed Roberts Campus (ERC), a new 80,000 square foot office building for disability rights organizations constructed at the Ashby BART station in Berkeley in 2010. The $50 million project is a model for accessible design that is integrated with access to the BART station. ECB secured NMTC financing for a portion of the project that resulted in over $8 million in net proceeds to fund tenant improvements and repayment of a portion of the funding for the base building improvements. JP Morgan Chase was the NMTC investor utilizing the Targeted Populations provisions of the NMTC program.

- NMTC Investor – JPMorgan Chase

- CDEs – Northern California Community Loan Fund (NCCLF), National Development Council (NDC)

East Bay Center for the Performing Arts

The East Bay Center for Performing Arts provides a rich and diverse performing arts educational program for youth in low-income communities throughout Richmond and the East Bay. ECB was the project manager for the East Bay Center’s rehabilitation of the Winters Building as home for its new performing arts and education facilities and secured NMTC financing to fill the $3 million funding gap for the Center’s construction. Funding sources included the contribution of the building by the City of Richmond, an additional $3.2 million in grants and a bridge loan from the City, grant funds from the California Cultural and Heritage Endowment (CCHE) and capital campaign funds raised by the East Bay Center.

- NMTC Investor – JPMorgan Chase

- CDEs – Local Initiative Support Corporation (LISC)

American Conservatory Theater/Strand

ECB managed the rehabilitation of the long-abandoned historic Strand Theater in San Francisco’s Mid-Market neighborhood as a 280-seat second stage theater for the City’s premier nonprofit theater company, American Conservatory Theater (A.C.T.). The project will serve as a performance venue and educational center to neighborhood school students and young actors and will expand A.C.T.’s artistic and educational outreach to the surrounding minority and low-income community in the Tenderloin and Central Market neighborhoods. ECB secured $34 million in NMTC allocation from 3 CDEs and $3 million in historic tax credit equity and provided project management and construction management services for A.C.T. The project financing closed in summer 2013.

- NMTC Investor – USBank – $11 million

- Historic Tax Credit Equity Investor – Clearinghouse CDFI – $3 million

- CDEs – Clearinghouse CDFI, NCCLF, San Francisco Community Investment Fund, USBCDC

Simpson Center for Girls

Girls Inc. of Alameda County is a nonprofit whose mission is to inspire all girls to be strong, smart, and bold. Girls Inc. provides year-round academic achievement and skills-building programs, as well as counseling services to over 7,500 girls and families. The new Simpson Center for Girls, in downtown Oakland’s historic district, provides extensive educational programs and supports continued economic development in the surrounding low-income community. ECB secured $18 million in NMTC allocation and $2.2 million in historic tax credit equity and provided project management and construction management services to renovate the historic building for Girls Inc. Funding closed in August 2012; the project was completed in summer 2013.

- NMTC Investors – USBank and Bank of America – $5.4 million

- Historic Tax Credit Investor – USBank – $2.2 million

- CDEs – Clearinghouse CDFI, Bank of America

YMCA Teen Center

With a focus on academic achievement, career preparation, service learning and leadership development, the YMCA Teen Center aims to empower high school age youth to develop the life skills and competencies necessary to becoming responsible community members. The Teen Center advances education achievement for youth. ECB provided project management and NMTC financing services to the YMCA of the Central Bay Area for the development of the YMCA Teen Center in downtown Berkeley. The $10 million project included leveraging the value of the existing building donated by PG&E in order to support increased NMTC financing. Project funding occurred in December 2009 and construction was completed in November 2010.

- NMTC Investor – Wells Fargo

- CDE – Wells Fargo

Family House

The Family House Inc provides temporary housing and support services to families whose children are undergoing treatment for cancer or other life-threatening diseases at the UCSF Benioff Children’s Hospital in Mission Bay. The new Family House Mission Bay location was not within an NMTC qualified low income census tract so ECB secured $12.2 million in NMTC financing using the Targeted Populations provisions in the NMTC regulations based on the fact that over 70% of Family House’s employees were hired from low income households. The NMTC financing provided the critical subsidy to complete the project funding and the new facility is now under construction.

- NMTC Investor – Capital One

- CDEs – Northern California Loan Fund and Capital One

Carson Block Building

The Northern California Indian Development Council (NCIDC) retained ECB to secure NMTC and Historic Tax Credit financing for the seismic upgrade, façade restoration and rehabilitation of the historic Carson Block Building in the historic downtown district of Eureka, California. The building provides affordable office space for NCIDC, which serves Native American tribes throughout Northern California. The state mandated seismic improvements to the historic masonry building will allow NCIDC to maintain occupan cy of the building and offer affordable space to other nonprofit organizations and retail tenants that will help stimulate economic development in Eureka’s downtown.

- NMTC Investor – USBank

- CDEs – Consortium America and California Statewide Community Development Corporation

- HTC Bridge Lender – Northern California Loan Fund

Ravenswood Family Health Center

ECB secured $38.9 million in NMTC financing for construction of the new 40,000 square foot clinic facility for the Ravenswood Family Health Center, a Federally Qualified Health Center that serves the low income community of East Palo Alto. The project funding combined a $5 million HRSA grant, proceeds from a capital campaign, and bridge loans from the Packard Foundation, LIIF and PCDC. The NMTC closing occurred in November 2014 during construction, with construction and occupancy scheduled to occur on time in April 2015.

- NMTC Investor – JP Morgan Chase

- CDEs – Opportunity Fund, PCDC and LIIF

Boys & Girls Clubs of San Francisco, Fulton Street

The Boys & Girls Clubs of San Francisco (BGCSF) provides recreation, education, mentoring and counseling activities for youth in San Francisco’s most challenging low-income communities. ECB secured New Markets Tax Credit financing for the new Fulton Street Clubhouse with $30 million in NMTC allocation. USBank was the NMTC equity investor and also provided up to a $15 million bridge loan as part of the overall project financing that closed in July 2013.

- NMTC Investor – USBank

- CDE – San Francisco Community Investment Fund (SFCIF), Opportunity Fund and USBCDC

SFJAZZ Center

In addition to being a premier facility for jazz performance, the Center supports extensive educational programs to the community and has supported continued economic development in the surrounding low-income community. ECB secured $41 million in NMTC allocation from four CDEs on behalf of the San Francisco Jazz Organization in order to complete the funding for the SFJAZZ Center at the corner of Franklin and Fell Street in San Francisco. ECB also assisted in securing a $13 million bridge loan from First Republic Bank secured by existing capital campaign pledges. Funding occurred in 2011 and the project opened in January 2013.

- NMTC Investor – USBank

- CDE – San Francisco Community Investment Fund (SFCIF), Nonprofit Finance Fund (NFF), Northern California Community Loan Fund (NCCLF) and Clearinghouse CDFI

San Francisco Wholesale Produce Market

The first phase expansion and redevelopment of the San Francisco Wholesale Produce Market provides warehouse and distribution facilities for local produce companies, which will help ensure the long-term viability of a critical resource to the City in its role as a leader in the movement to promote healthy food and lifestyles. The San Francisco Market Corporation retained ECB to secure $23.2 million in NMTC financing combined with a $15 million loan. The project financing closed in June 2013.

- NMTC Investor – Bank of America

- CDE – San Francisco Community Investment Fund (SFCIF) and Bank of America

College Track

College Track provides education, mentoring, job training and counseling services to youth in low-income communities with a focus on preparing students for college admissions as often the first in their family to attend college. ECB secured $8.7 million in NMTC allocation on behalf of College Track in 2011 in order to complete the funding for the College Track building in the Bayview Hunters Point neighborhood in San Francisco.

- NMTC Investor – USBank

- CDE – San Francisco Community Investment Fund (SFCIF)

Chinatown YMCA

ECB assisted the San Francisco YMCA in securing $17.5 million in NMTC financing for the redevelopment of the historic Chinatown YMCA in downtown San Francisco. The YMCA advances education achievement for youth and provides recreational activities for the low-income community. The funding leveraged the existing building value, prior costs incurred over several years of predevelopment planning and capital campaign funds to maximize the net value of the NMTC equity. Funding occurred in January 2008 and the project was completed in 2010.

- NMTC Investor – USBank

- CDE – Renaissance Capital

Bayview YMCA

ECB assisted the San Francisco YMCA in securing $5 million in NMTC financing for the redevelopment of the Bayview YMCA in the Bayview district of San Francisco in 2008. The YMCA advances education achievement for youth and provides recreational activities for the low-income community. The funding leveraged the existing building value, prior costs incurred and capital campaign funds to maximize the net value of the NMTC equity.

- NMTC Investor – USBank

- CDE – Opportunity Fund

Richmond Maritime Center

The Richmond Maritime Center is an historic World War Two era daycare center located in the poverty-stricken Iron Triangle neighborhood. The dilapidated building was completely rehabilitated and historically restored and now serves the community as a preschool, public park interpretive center, and home to a local non-profit organization, Richmond Community Foundation. The project has supported continued economic development in the surrounding low-income community. ECB was retained by the Rosie the Riveter Trust to secure NMTC and Historic Tax Credit (HTC) financing for the rehabilitation of the historic Maritime Center building in Richmond, which was already under construction but short of funding. ECB secured approximately $9 million in NMTC allocation from NCCLF and negotiated the terms of the NMTC and HTC equity investment with JPMorgan Chase. Financing closed in November 2010 and the project was completed in August 2011.

- NMTC and Historic Tax Credit Investor – JPMorgan Chase – $4.9 million

- CDE – Northern California Community Loan Fund (NCCLF)

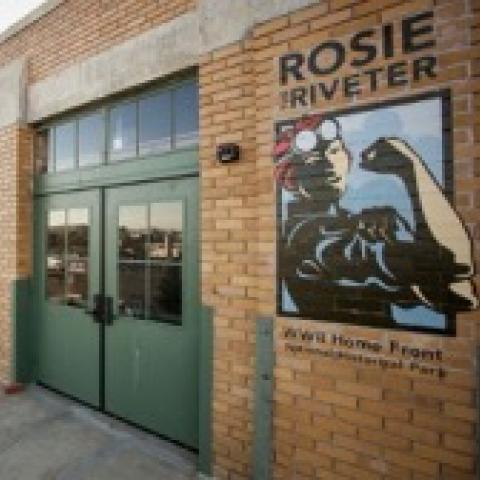

Richmond Oil House/Rosie the Riveter Visitor Center

ECB was retained by the City of Richmond to assist in securing NMTC and HTC financing for Rosie the Riveter visitor center to be operated by the National Park Service at the historic Ford Plant at Point Richmond. The Visitor Center embraces and celebrates the history of Richmond and advances cultural education. ECB worked with project developer, Orton Development Inc., to structure the project funding. Bank of America provided the NMTC allocation and served as the investor for both the NMTC and HTC. Funding closed in March 2011, securing $6.8 million in NMTC allocation.

- NMTC and Historic Tax Credit Investor – Bank of America – $2 million

- CDE – Bank of America

Freight and Salvage

Freight and Salvage is a nonprofit community arts organization dedicated to the promotion and understanding of traditional and roots music, which also supports extensive educational programs to the community. ECB was retained by the Berkeley Society for the Preservation of Traditional Music to secure NMTC financing for the recently completed construction of the new Freight and Salvage performance venue in Berkeley’s downtown arts district.

- NMTC Investor – Wells Fargo

- CDE – Wells Fargo

Lighthouse for the Blind

Lighthouse for the blind is a San Francisco based nonprofit that has been providing services to blind and low vision people of all ages for 113 years. ECB was retained by Lighthouse to secure NMTC financing for their new 39,000 square foot headquarters facility at 1155 Market Street in San Francisco. ECB secured $17.5 million in NMTC allocation from ESIC New Markets Partners and USBank as the tax credit investor. The NMTC financing closed in December 2015.

- NMTC Investor – USBank

- CDE – ESIC New Markets Partners and USBCDC (USBank)

San Francisco LGBT Center

ECB managed the redevelopment of the SF LGBT Center at 1800 Market Street to consolidate the Center’s office, programmatic and meeting facilities on the two lower floors, creating affordable office space for nonprofit organizations on the upper two floors and stabilizing the Center’s operations. ECB secured $11 million in NMTC allocation and $4.5 million in bank financing from NCCLF and Capital One. Construction commenced in March of 2016 with occupancy in late 2016.

- NMTC Investor and Lender – Capital One

- CDE – Northern California Community Loan Fund and Capital One

Lao Family Care Center

ECB secured $13.43 million in NMTC allocation for the redevelopment of a former 30,000 sf former antique showroom warehouse into a mixed-use center for Lao Family Community Development services to provide adult and ESL education instruction, a café, a multiuse conference center, co-working space, community therapy garden for seniors, indoor and outdoor active space for youth and senior activities. The NMTC closing occurred in August 2017 and JP Morgan Chase was the NMTC equity investor and California Statewide Communities Development Corporation provided the NMTC allocation.

- NMTC Investor – JP Morgan Chase

- CDE - California Statewide Communities Development Corporation

OLE Health Center

ECB secured $30.6 million in NMTC financing for construction of the new 29,000 square foot clinic facility for the OLE Health Center, a Federally Qualified Health Center that serves the low-income community of Napa and Solano Counties. The project funding combined county and philanthropic grants, proceeds from a capital campaign, sponsor equity and a bridge loan. The NMTC closing occurred in May 2017 with construction and occupancy completed in late 2018.

- NMTC Investor – JP Morgan Chase

- CDEs – Opportunity Fund, Nonprofit Finance Fund, Capital Impact Partners, JP Morgan Chase

Compass Family Services

Compass Family Services provides support services to homeless families in San Francisco, serving more than 5,000 parents and children each year. ECB secured $14.2 Million in NMTC allocation with JP Morgan Chase and Opportunity Fund and debt from Low Income Investment Fund for the purchase and renovation of Compass Family Services facility providing a permanent home for the organization. NMTC closing occurred June 2018.

- NMTC Investor – JP Morgan Chase

- CDEs – Opportunity Fund, JP Morgan Chase

Seminary Point

ECB Secured $14 Million in NMTC financing for Seminary Point from Capital One and Oakland Renaissance NMTC and debt from Boston Private Bank & Trust. The project, which closed NMTC financing in December of 2016, is 27,000 SF of neighborhood serving retail space. The Center provides needed community retail services in an area that has struggled to attract and retain tenants and supports Oakland’s focus to attract private investment to support key retail businesses in this former Redevelopment Area.

- NMTC Investor – Capital One

- CDE – Oakland Renaissance NMTC

RYSE Commons

RYSE offers education and health programming, leadership skills and career development at no charge to low-income youth serving more than 3,700 members annually. ECB secured $11.55 Million in NMTC allocation with USBank and Opportunity Fund and debt from Raza Development Fund and Community Vision for the renovation and new construction of RYSE Commons which will allow for 3,000 additional members. NMTC closing occurred June 2019.

- NMTC Investor – US Bank

- CDEs – Opportunity Fund

Mission Kids

ECB Secured $7.56 million in NMTC allocation to build a new home for Mission Kids, a cooperative preschool providing family services programs to families in San Francisco’s Mission District and surrounding neighborhoods. Additional funding was provided by capital campaign donations and a grant from Low Income Investment Fund and Community Vision to complete this $9.6 million project. NMTC closing occurred in October 2019.

- NMTC Investor – US Bank

- CDE – Low Income Investment Fund

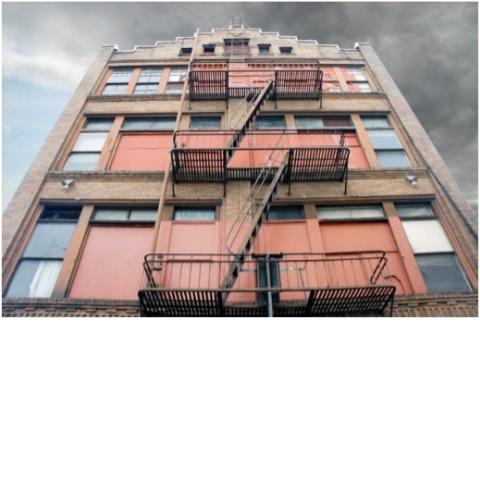

447 Minna St.

447 Minna provides below market rental space for Bay Area Arts organizations. ECB Secured $8 million in NMTC allocation to rehabilitate this historic building. Additional funding was provided by project sponsor, Community Arts Stabilization Trust, city grant and a loan from Community Vision to complete this project. NMTC closing occurred in January 2020.

- NMTC Investor –JP Morgan Chase

- CDE – San Francisco Community Investment Fund

Oakland Museum of California

ECB Secured $14 million in NMTC allocation to renovate the Oakland Museum of California campus and gardens. Additional funding was provided by capital campaign donations, city grant and a loan from First Republic Bank to complete this $20 million project. NMTC closing occurred in May 2020.

- NMTC Investor – Capital One

- CDE – Oakland Renaissance NMTC and Capital One

Oakland Civic

ECB Secured $28 million in NMTC allocation and $7 million to renovate the historic former auditorium and theater, which is ground-leased from the City of Oakland. Additional funding was provided by developer equity, philanthropic funding, Opportunity Zone financing and a loan from Comerica Bank to complete this $36 million project. NMTC closing occurred in December 2020.

- NMTC Investor – US Bank

- HTC Investor – Bank of America

- CDEs – Oakland Renaissance NMTC, TELACU, Clearinghouse and Citiscape Capital

Community Music Center

For more than 100 years Community Music Center has been providing high-quality music education accessible to people of all backgrounds and ages regardless of their financial means in the Mission District and throughout San Francisco. ECB Secured $12.05 million in NMTC allocation. NMTC closing occurred in December 2020.

- NMTC Investor – US Bank

- CDE – San Francisco Community Investment Fund

Caritas Center

Caritas Center provides supportive services for the homeless and near homeless, a medical respite for homeless and a Federally Qualified Health Center in downtown Santa Rosa, CA. ECB Secured $39.5 million in NMTC allocation to build this 46,500 SF facility. Additional funding was provided by capital campaign and loans from Poppy Bank and Exchange Bank Vision to complete this project. NMTC closing occurred in June 2021.

- NMTC Investor – JP Morgan Chase

- CDEs – TELACU, Clearinghouse, Enterprise and JP Morgan Chase

Shasta Community College Leadership Center

Shasta Community College Leadership Center replaced an obsolete parking structure with a new 22,500 SF facility that will be downtown Redding’s economic springboard to connect the surrounding low-income community by offering workforce development services and job training. ECB Secured $22.5M in NMTC allocation to build this facility. Additional funding was provided by taxable municiple bonds. NMTC closing occurred in March 2022.

- NMTC Investor – PNC Bank

- CDEs – California Statewide Community Development Corporation, Urban Action Community Development and PNC Bank

Renewal Center

The Renewal Center project includes the new construction of a 27,000 SF building and renovation of a 20,000 SF facilility to provide shelter and social services to Chico’s homeless population. ECB Secured $18.5M in NMTC allocation to build this facility. Additional funding was provided by capital campaign funds and a loan from Raza Development Fund and Community Vision. NMTC closing occurred in March 2022.

- NMTC Investor – Capital One

- CDEs – California Statewide Community Development Corporation, Accion Opportunity Fund

Hamilton Families

Hamilton Families is a nonprofit working to end family homelessness in the San Francisco Bay Area. Hamilton Families core programs center on preventing family homelessness when possible, providing shelter and temporary housing to families in times of need, supporting the wellbeing and academic achievement of children who experience homelessness, and quickly returning families to safe and stable housing throughout the Greater Bay Area. ECB secured $13.4 million of NMTC allocation and a $7.6 million source loan for the acquisition and rehabilitation of an approximately 14k SF building in San Francisco’s Mission district. The new site will serve as an anchor institution for the community and families experiencing homelessness, and allow Hamilton Families to consolidate and expand administrative offices, expand its Rapid Rehousing social service programs and increase the number of families served. NMTC financing closed in February 2023. ECB is also providing project and construction management.

- NMTC Investor – Capital One

- CDE – San Francisco Community Investment Fund

Sunnydale Community Center

The Sunnydale Community Center is a 28k SF hub of neighborhood activity with youth and family programs, recreational and community amenities being developed by Mercy Housing, CA. The Community Center is part of the larger 1,700 unit, 50-acre, Sunnydale HOPE SF Neighborhood Plan, which seeks to transform four of San Francisco’s most distressed public housing sites into vibrant, thriving communities through holistic revitalization. The Community Center project will include 8k SF of early childhood education programs operated by Wu Yee Children’s Services and serving low-income children, 12k SF of space operated by the San Francisco Boys and Girls Club to provide youth programs for local youth through, and 8k SF of neighborhood space with community and multi-purpose rooms, outdoor play space and landscaped outdoor areas. ECB secured $41.6 million of NMTC allocation and a $1.5 million capital campaign bridge loan. Financing closed in December 2022 and the project completed in September 2024.

- NMTC Investor – Wells Fargo

- CDEs – San Francisco Community Investment Fund, Low Income Investment Fund

Canal Alliance

Canal Alliance serves the predominately Latino community in the Canal District of San Rafael by providing a variety of programming, from immigration legal services, education for K through 12 students, vocational services for adults, food pantry and health services. ECB secured $13.5 million of NMTC allocation and a $3.4 million loan for the renovation of the 18,000 SF facility. Financing closed in September 2023 and project completion date is September 2024.

- NMTC Investor – JP Morgan Chase

- CDE – Raza Development Fund, JP Morgan Chase

Friendship House

Friendship House is an Indigenous-led organization that believes culture is medicine providing health, wellness, housing, social service and cultural identity programming for urban American Indians in San Francisco. ECB secured $13.5 million of NMTC allocation of working capital to expand the programming of FQHC health and dental care, cultural and community services for Friendship House’s new 45,000 SF headquarters. Financing closed in August 2024.

- NMTC Investor – Capital One

- CDE – San Francisco Community Investment Fund

Community Forward

Community Forward helps the most vulnerable find comprehensive services and achieve stability. The pillars of care are supportive housing, medical & behavioral health and women’s services. ECB secured $19.6 million of NMTC allocation of working capital to expand services, increasing housing capacity for individuals with substance use disorders, introducing mental health and clinical services and supporting administrative planning for a new women’s center. Financing closed in April 2025.

- NMTC Investor – Capital One

- CDE – San Francisco Community Investment Fund

Little Manila Rising

Little Manila Rising is a community-based organization in South Stockton, CA, which develops equitable solutions to combat the effects of historical marginalization, redlining, institutional racism and harmful public policy. Little Manila’s programs sit at the intersection of climate justice and public health, implemented through culturally-rooted, after-school education, mental health, workforce development, arts & culture, land stewardship and air pollution/asthma mitigation efforts. ECB secured $7 million of NMTC allocation, plus an additional $2.3M of low-interest, flexible financing for the rehabilitation of the Little Manila Rising Center, transforming a former historic Filipino community center into a 7.3k SF vibrant community hub of climate justice, sustainability and resilience.

- NMTC Investor – Capital One

- CDE – Central Valley NMTC

Historic Tax Credit Projects

In addition to the above NMTC and HTC transactions, ECB has been involved as developer or project manager/financial consultant on numerous Historic Tax Credit transactions totaling over $35 million in historic tax credit equity:

Cavallo Point, Sausalito, CA

- ECB was the developer and project manager for the $100 million 142 room hotel and conference center at Fort Baker in Sausalito.

38 Keyes Avenue, Presidio of San Francisco, CA

- ECB was the developer for the historic rehabilitation of the 60,000 square foot conversion of the 6th Army Headquarters to office space in the Presidio.

Thoreau Center for Sustainability, Presidio of San Francisco, CA

- ECB secured $12M in HTC Equity and was the developer for conversion of the historic Letterman Hospital in the Presidio to a center for nonprofit organizations.

Shriners Hospital, San Francisco, CA

- ECB was the development manager for conversion of the historic Shriners Hospital on 19th Avenue to a senior housing/assisted living facility.

Fort Mason Center, San Francisco, CA

- $25 million rehabilitation of the historic Pier 2 at Fort Mason Center for theater, event and educational space.

The Bay School of San Francisco, Presidio of San Francisco,CA

- John Clawson was a founding board member and coordinated the overall development and financing for the new high school in the Presidio.

American Conservatory Theater/Strand, San Francisco, CA

- In addition to $34 million in NMTC allocation, ECB secured $3 million in historic tax credit equity, provided project management, and construction management services.

Simpson Center for Girls, Oakland, CA

- In addition to securing $18 million in NMTC allocation, ECB secured $2.2 million in historic tax credit equity, provided project management, and construction management services to renovate the historic building for Girls Inc.

Carson Block Building, Eureka, CA

- ECB was the tax credit consultant for Northern California Indian Development Council (NCIDC) and secured $5.46 million in NMTC equity generated on $14 million allocation; $2.9 million of HTC equity.

Pantages Theater, Tacoma, WA

- ECB was the tax credit consultant and secured HTC equity for the $10.5 million renovation of Pantages Theater in Tacoma, WA.

Oakland Civic, Oakland, CA

- In addition to $28 million in NMTC allocation, ECB secured $7 million in historic tax credit equity.